General Overview

Objectives

The Education Directorate (the Directorate) prioritises quality education and childcare to shape every child and young person’s future and to lay the foundation for lifelong development and learning. The Directorate works in partnership with students, parents and the community to ensure that every child and young person in the ACT will benefit from high quality, accessible education to position the ACT as the Education Capital: Leading the Nation.

This is being achieved by delivery and implementation of a broad range of services and activities under five key domains, namely:

- Quality learning – ensuring learners have access to powerful and relevant learning experiences;

- Inspirational teaching and leadership – building the capabilities of our teachers and leaders;

- High expectations, high performance – having high expectations for all and meeting the learning needs of every student;

- Connecting with families and the community – partnering with families and engaging with the community to build meaningful relationships; and

- Business innovation and improvement – improving our business systems, and being open and accountable for our decisions.

In addition to the provision of public school education and early childhood education programs, the Directorate is responsible for the regulation of education and care services, registration of nongovernment schools and home education. On 22 January 2016, the vocational education and training functions transferred to the Chief Minister, Treasury and Economic Development Directorate (CMTEDD) and on 1 July 2016 special needs transport services transferred to the Transport Canberra and City Services Directorate (TCCS).

Risk Management

The development of the Directorate’s annual Strategic Risk Management and Audit Plan identified risks that could impact on the Directorate’s operations and objectives. The key risks provided below are medium to long-term risks that are monitored by the Directorate’s executive and senior management.

Key risks, including mitigation strategies, are identified below:

- Lack of organisational capability and capacity to implement complex reform programs. The Directorate has a strong project management culture; has rigorous project management around complex reform programs (such as project planning for the Schools for All, Student Resource Allocation and Student Administration System reform programs) and has comprehensive corporate governance processes. In 2017, the Directorate established a Reform Program Board to strengthen governance and oversight of complex reform programs.

- Increase in security incidents occurring locally, national and internationally which have a direct impact on Canberra public school students, staff and the Directorate. The Directorate annually reviews emergency management frameworks and plans. Evacuation and lock down exercises are undertaken on a regular basis. In 2016, the Directorate undertook work to improve emergency response in complex settings, including specialist schools. The Directorate has policies and procedures in place to support online safety for students.

- Increase in occupational violence. In 2016 and 2017 the Directorate undertook a number of actions to continue to improve safety in the workplace, including hosting occupational violence risk workshops, raising awareness of workplace health and safety obligations of staff and delivery of refresher training for school principals. The Directorate has developed an ACT Education Directorate Managing Occupational Violence Policy and Plan for launch in July 2017.

- Misalignment between school and organisational effort and expectations of government and community. The Directorate provides alignment through key strategic documents including the Directorate’s Strategic Plan 2014-17: Education Capital: Leading the Nation and the 2017 Action Plan. Strategic plans are communicated to schools and the community, and schools are supported in ensuring alignment through system wide planning processes.

- Ageing school infrastructure that is not ‘fit for purpose’. The Directorate conducts strategic asset management planning; provides timely advice to government about risks and associated remediation options and has focused investment on core issues – such as heating and cooling systems and electrical works.

- Information management systems unable to support good decision making and compliance obligations. The Directorate has a comprehensive set of frameworks, toolkits and manuals to support informed decision making and compliance. These include People, Practice and Performance (a framework for performance and accountability), the School Legal Information Manual, and the Director-General’s Financial Instructions. In 2017, the Directorate launched a new portal on its website improving access to Directorate policies and procedures. The Directorate has developed an ACT Education Directorate Governance Guide for launch in August 2017.

- Workforce incapable to meet needs of modern and progressive education systems. The Directorate has a comprehensive professional development planning process in place and provides professional learning opportunities to staff. For example, all Directorate staff are required to have a professional development plan. Professional learning is provided through external sources and internally through online training modules. Teachers are provided 20 hours (at a minimum) of training accredited through the ACT Teacher Quality Institute.

Accounting Changes

There were two significant accounting changes that impacted the 2016-17 financial statements. The changes are detailed below.

- The Australian Accounting Standards Board (AASB) has amended the scope of AASB 124 Related Party Disclosures to include public sector entities. The objective of the standard is to ensure an entity’s financial statements contain the disclosures necessary to draw attention to the possibility that its financial position and profit and loss may have been affected by the existence of related parties and transactions with such parties.

- In 2016-17 the Directorate revalued its land, building and ground improvement assets as at 30 June 2017.

Directorate Financial Performance

The Directorate has managed its operations within the 2016-17 budgeted appropriation. During the financial year, the Directorate achieved savings targets and internally managed cost pressures associated with increased enrolments including increases in numbers of students with a disability.

The table below provides a summary of the financial operations based on the audited financial statements for 2015-16 and 2016-17.

Table C1.1: Net Cost of Services

| Net Cost of Services | Actual $m | Amended Budget1 $m | Actual $m |

|---|---|---|---|

| Total expenditure | 728.9 | 733.9 | 729.2 |

| Total own source revenue2 | 42.2 | 41.6 | 42.4 |

| Net cost of services | 686.7 | 692.3 | 686.8 |

Notes

1 The Amended Budget incorporates the transfer of special needs transport services to TCCS through a Section 16 Financial Instrument under the Financial Management Act 1996.

2 Relates to Total Revenue excluding Controlled Recurrent Payments.

Net Cost of Services

The Directorate’s net cost of services for 2016-17 of $686.7 million was $5.6 million or 0.8 per cent lower than, and materially in line with the 2016-17 amended budget of $692.3 million.

In comparison to 2015-16, the net cost of services in 2016-17 decreased by $0.1 million. The net decrease is due to the transfer of vocational education and training functions to CMTEDD on 22 January 2016 and the transfer of special needs transport functions to TCCS offset by additional employee expenses associated with the Teaching Staff Enterprise Agreement and Administrative and Other Staff Enterprise Agreement and an increase in teacher numbers to meet enrolment growth.

Operating Result

In 2016-17, the operating deficit for the Directorate was $58.6 million and was $3.1 million or 5 per cent lower than the amended budget of $61.7 million. The variance was primarily due to lower than anticipated employee provisions due to the application of a lower than budgeted rate to estimate the present value of employee liabilities. The operating deficit of $58.6 million was $1.6m or materially in line with the 2015-16 operating deficit of $60.2 million.

The 2016-17 total comprehensive surplus totalled $82.0 million as a result of the revaluation of the Directorate’s assets as at 30 June 2017. In line with ACT Government policy, the Directorate engages an independent valuer to revalue land, building and ground improvement assets every three years.

Total Revenue

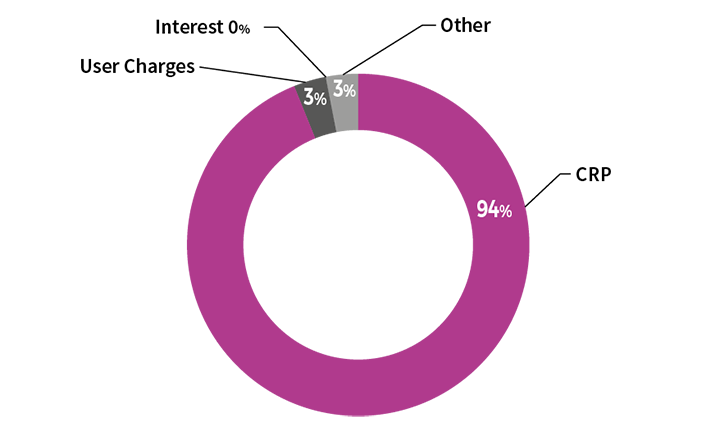

Components of Revenue

The Directorate’s revenue for 2016-17 totalled $670.3 million. The main source of revenue for the Directorate is Controlled Recurrent Payments which provided 94 per cent of the Directorate’s Total Revenue.

Figure C1.1: Components of Revenue 2016-17

Source: Education Directorate’s 2016-17 Financial Statements.

The Directorate’s revenue for 2016-17 ($670.3 million) was materially in line with the amended budget ($672.1 million). In comparison to the previous year, revenue increased by $1.3 million or 0.2 per cent.

The increased revenue from 2015-16 is primarily due to additional funding received for increased wages associated with the enterprise agreements for teaching and non-teaching staff combined with increased funding for enrolment growth and Commonwealth grants. These increases were partially offset by the transfer of vocational education and training functions to CMTEDD on 22 January 2016 and the transfer of special needs transport services to TCCS on 1 July 2016.

Total Expenses

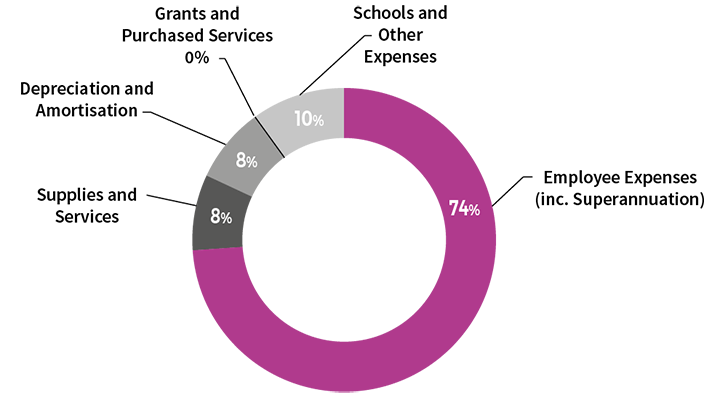

Components of Expenses

Expenses for the Directorate totalled $728.9 million for 2016-17. As shown in Figure C1.2, the main component of expenses is employee expenses, including superannuation, comprising 74 per cent of total expenses.

Figure C1.2: Components of Expenditure 2016-17

Source: Education Directorate’s 2016-17 Financial Statements

In 2016-17, total expenses at $728.9 million were $5.0 million or 0.7 per cent lower than the amended budget of $733.9 million primarily related to lower than anticipated employee provisions due to the application of a lower than budgeted rate to estimate the present value of employee liabilities.

Total expenses were $0.3 million lower than the previous year ($729.2 million). The decrease mainly relates to the transfer of vocational education and training functions to CMTEDD on 22 January 2016 and the transfer of special needs transport functions to TCCS on 1 July 2016. The decrease was largely offset by additional employee expenses associated with new enterprise agreements for teaching and non-teaching staff and enrolment growth.

Table C1.2: Line Item Explanation of Significant Variances from the Amended Budget – Controlled Operating Statement

| Variance from Budget | Actual2016-17 $m | AmendedBudget2016-17 $m1 | Variance $m2 |

|---|---|---|---|

| Revenue | |||

| Controlled Recurrent Payments | 628.1 | 630.6 | (2.5) |

| User charges | 18.5 | 18.0 | 0.5 |

| Interest and distribution from investments | 1.2 | 1.5 | (0.3) |

| Resources received free of charge | 0.6 | 0.6 | (0.0) |

| Other revenue | 21.9 | 21.4 | 0.5 |

| Total Revenue2 | 670.3 | 672.1 | (1.8) |

| Variance from Budget | Actual2016-17 $m | AmendedBudget2016-17 $m1 | Variance $m2 |

|---|---|---|---|

| Expenses | |||

| Employee expenses | 469.7 | 469.9 | (0.2) |

| Superannuation expenses | 69.4 | 70.0 | (0.6) |

| Supplies and services3 | 55.6 | 62.2 | (6.6) |

| Depreciation | 61.8 | 59.9 | 1.9 |

| Grants and purchased services4 | 2.7 | 6.1 | (3.4) |

| Other5 | 69.7 | 65.8 | 3.9 |

| Total Expenses2 | 728.9 | 733.9 | (5.0) |

Notes:

1 The Amended Budget incorporates the transfer of special needs transport functions to TCCS on 1 July 2016.

2 Figures may not add due to rounding.

3 The lower than budgeted supplies and services expenses mainly relates to capitalisation of some recurrent expenditure associated with works in schools as well as rollovers into 2017-18.

4 Lower than anticipated grants and purchased services primarily relates to the reclassification of costs associated with the National Disability Insurance Scheme (NDIS) to other expenses as well as rollovers into 2017-18.

5 Higher than anticipated other expenses mainly relates to the reclassification of costs associated with the NDIS from grants and purchased services.

Financial Position

Total Assets

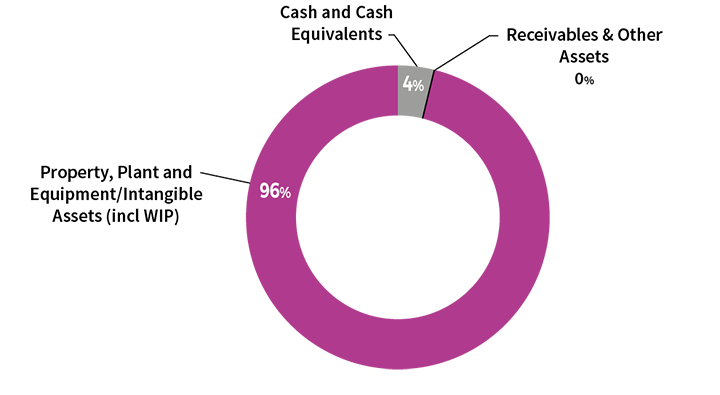

Components of Total Assets

The Directorate held 96 per cent of its assets in property, plant and equipment including capital works in progress and 4 per cent related to cash and cash equivalents, receivables and other current assets.

Figure C1.3: Total Assets at 30 June 2017

Source: Education Directorate’s 2016-17 Financial Statements.

Comparison to Budget

At 30 June 2017, the Directorate’s assets totalled $2.0 billion, which was $119.0 million or 6.3 per cent higher than the amended budget. This is primarily related to the revaluation increment of the Directorate’s assets as at 30 June 2017. This was partially offset by the rollover of funds for some capital works projects to 2017-18.

In comparison to 30 June 2016, total assets increased by $105.4 million or 5.6 per cent primarily due to the revaluation increment for land, buildings and improvements to land.

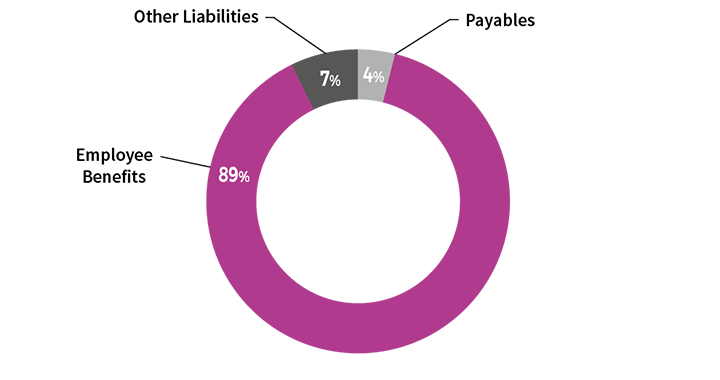

Components of Total Liabilities

Figure C1.4: Total Liabilities at 30 June 2017

Source: Education Directorate’s 2016-17 Financial Statements.

At 30 June 2017, the Directorate’s liabilities totalled $161.8 million. This was $7.5 million or 4.9 per cent higher than the amended budget of $154.3 million primarily related to an increase in employee benefits due to an increase in the rate used to estimate the present value of long service leave payments.

In comparison to 30 June 2016, total liabilities decreased by $2.5 million or 1.5 per cent primarily relating to a decrease in employee benefits due to a lower rate used to estimate the present value of long service leave payments. The decrease was partially offset by the impact of wages and salaries increases.

Current Assets to Current Liabilities

At 30 June 2017, the Directorate’s current assets ($82.8 million) were lower than its current liabilities ($146.6 million). The Directorate does not consider this as a liquidity risk as cash needs are funded through appropriation from the ACT Government on a cash needs basis.

The Directorate’s current liabilities primarily relate to employee benefits, and while the majority are classified under a legal entitlement as current, the estimated amount payable within 12 months is significantly lower and can be met with current assets. In addition, in the event of high termination levels requiring significant payment for leave balances, the Directorate is able to meet its obligations by seeking additional appropriation under Section 16A of the Financial Management Act 1996.

Table C1.3: Line Item Explanation of Significant Variances from the Amended Budget - Controlled Balance Sheet

| Variance from Budget | Actual 30 June 2017 $m | Amended Budget 30 June 2017 $m1 | Variance $m2 |

|---|---|---|---|

| Current assets | |||

| Cash and cash equivalents3 | 77.8 | 63.9 | 13.9 |

| Receivables4 | 2.9 | 5.1 | (2.2) |

| Investments | 0.3 | 0.3 | - |

| Other Assets | 1.9 | 0.9 | 1.0 |

| Total current assets | 82.9 | 70.2 | 12.7 |

| Non-current assets | |||

| Investment | 1.9 | 1.9 | - |

| Property, plant and equipment and intangible assets (including capital works in progress)5 | 1,916.1 | 1,809.7 | 106.4 |

| Total non-current assets | 1,918.0 | 1,811.6 | 106.4 |

| Total assets2 | 2,000.8 | 1,881.7 | 119.0 |

| Variance from Budget | Actual 30 June 2017 $m | Amended Budget 30 June 2017 $m1 | Variance $m2 |

|---|---|---|---|

| Current liabilities | |||

| Payables6 | 7.1 | 5.3 | 1.7 |

| Employee benefits7 | 132.8 | 127.5 | 5.2 |

| Other | 6.8 | 4.8 | 2.0 |

| Total current liabilities | 146.7 | 137.6 | 8.9 |

| Non-current liabilities | |||

| Employee benefits | 11.2 | 12.6 | (1.4) |

| Other borrowings | 4.0 | 3.9 | - |

| Total non-current liabilities | 15.2 | 16.5 | (1.4) |

| Total liabilitites2 | 161.8 | 154.3 | 7.5 |

Notes:

1 There were no changes to the original budget that impacted balance sheet items.

2 Figures may not add due to rounding.

3 Primarily related to extra cash held for the schools administration system ICT project.

4 Primarily relates to lower than budgeted goods and services tax receivable from the Australian Taxation Office.

5 Primarily due to the revaluation of the Directorate’s land, buildings and ground improvement assets in 2016-17 that resulted in an increase in asset value.

6 Primarily relates to higher than budgeted capital works payables at year-end.

7 Primarily due to a higher than anticipated rate used to estimate the present value of long service leave and annual leave liabilities.

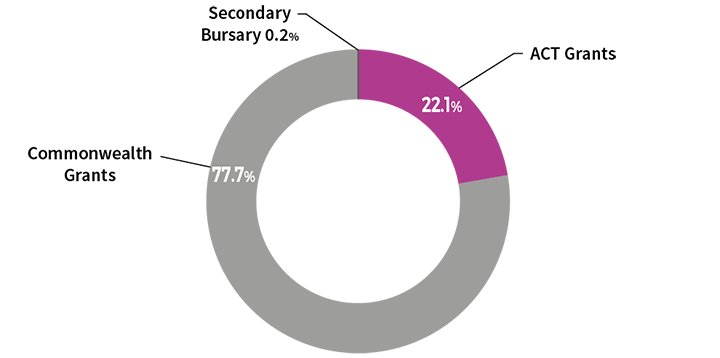

Territorial Statement of Revenue and Expenses

Territorial Revenue

Total income received included revenue for expenses on behalf of the Territory, primarily for the provision of grants to non-government schools.

Figure C1.5: Sources of Territorial Revenue

Source: Education Directorate’s 2016-17 Financial Statements.

Territorial revenue is mainly comprised of funding for non-government schools from the Commonwealth and ACT Government. It also included ACT Government funding for the Secondary Bursary Scheme.

Territorial revenue totalled $272.7 million in 2016-17, which was $5 million or 1.8 per cent lower than budget of $277.7 million. The reduced revenue primarily related to ACT Government grants due to lower than forecast enrolment levels in non-government schools.

When compared to the same period last year, total revenue increased by $12.7 million or 4.9 per cent primarily due to higher levels of general recurrent grants for non-government schools reflecting the impact of increased Commonwealth and ACT Government grants in accordance with the National Education Reform Agreement: Australian Capital Territory Bilateral Agreement’s ‘Schooling Resource Standard’.

Territorial Expenses

Territorial expenses primarily comprised of grant payments to non-government schools ($272.0 million). It also included ACT Government funding for the Bursary Scheme ($0.7 million). Territorial expenses in 2016-17 were $5 million or 1.8 per cent lower than budget. The reduced expenditure primarily related to ACT Government grants due to lower than forecast enrolment levels in non-government schools.

When compared to the same period last year, total expenses increased by $12.7 million or 4.9 per cent primarily due to higher levels of general recurrent grants for non-government schools reflecting the impact of increased Commonwealth and ACT Government grants in accordance with the National Education Reform Agreement: Australian Capital Territory Bilateral Agreement’s ‘Schooling Resource Standard’.

For more information contact:

Chief Finance Officer

Strategic Finance

Telephone: (02) 6205 2685